In the article, The Payroll Miracle, I have provided the definition of Payroll processes, and provided the calculation method of the employee Net Salary as well as the variables and functions used in calculating the net salary and the payroll data types, and sources. In this article, I shall describe Interact Payroll System Framework as it relates to the Payroll Definition described in the previous article. It is important to understand that each payroll system has its own framework and not all payroll frameworks are created equal. Some payroll frameworks are rigid and limited, while others are flexible and agile as they provide more flexibility accommodating multiple types of payroll setups to support specific payroll requirements of the organization, industry, business type, and country. Interact Payroll System Framework is highly flexible, it is policy driven, where all payroll rules and associated calculation methods are defined as policies during the payroll setup. Interact Payroll System supports fours types of Payroll, (1) Normal Payroll Cycle (NPC), (2) Off Cycle Payroll (OCP), (3) Retroactive Payroll (RP), and (4) End of Service Payroll (EOS). These four payroll types are supported by the one single Payroll Engine. All of these payroll types use the same Interact Payroll Framework, which we will be discussing in this article.

In the article, The Payroll Miracle, I have provided the definition of Payroll processes, and provided the calculation method of the employee Net Salary as well as the variables and functions used in calculating the net salary and the payroll data types, and sources. In this article, I shall describe Interact Payroll System Framework as it relates to the Payroll Definition described in the previous article. It is important to understand that each payroll system has its own framework and not all payroll frameworks are created equal. Some payroll frameworks are rigid and limited, while others are flexible and agile as they provide more flexibility accommodating multiple types of payroll setups to support specific payroll requirements of the organization, industry, business type, and country. Interact Payroll System Framework is highly flexible, it is policy driven, where all payroll rules and associated calculation methods are defined as policies during the payroll setup. Interact Payroll System supports fours types of Payroll, (1) Normal Payroll Cycle (NPC), (2) Off Cycle Payroll (OCP), (3) Retroactive Payroll (RP), and (4) End of Service Payroll (EOS). These four payroll types are supported by the one single Payroll Engine. All of these payroll types use the same Interact Payroll Framework, which we will be discussing in this article.

Payroll Calculation Definition Revisited

Before, presenting Interact Payroll System Framework, we need to revisit the Payroll Calculation (Net Salary Calculation) definition we have provided in the last article, so we link the Payroll Framework objects to the components of the Net Salary Calculation method (formula). The following is the Net Salary Calculation method that was presented in the previous article (The Payroll Miracle):

Payroll := Calculation(NS, Employeej,PPi )

where:

NS is the Net Salary

PPi is a specific Pay Period in the Year

NS (PPi) = GS(PPi) – D(PPi) – EBC(PPi)) – T(PPi)

where:

GS is Gross Salary

D represents the deductions

EBC represents Employee Benefits’ Contributions

Where:

GS(PPi) = ∑(Ej, PPi) + ∑(Aj, PPi) + ∑(Cj, PPi) + ∑(Bj, PPi) + ∑(Xj, PPi)

D(PPi) = ∑(Dj, PPi)

EBC(PPi) = ∑(EBCj, PPi)

Taxes (PPi) = functionk(TIj, PPi)

(TIj, PPi) = GS(PPi) – Exemptions(PPi

(Ej, PPi) = functionl(RH, OTHp,LHl, PPi)

(Aj, PPi) = functionq(Ej, PPi)

(Cj, PPi) = functionz(PGj, PPi)

E := Earnings

A := Allowances

C := Commissions

B := Bonuses

X := Expenses

D := Deductions

T := Taxes

EBC := Employee Benefits Contribution (from Benefits (F))

F:= Benefits

RH := Regular Hours Worked

OTH := Overtime Hours Worked

LH : Leave Hours

TI := Taxable Income

It is important to focus on the main/critical variables in the above Net Salary Calculation Method, which are:

E := Earnings

A := Allowances

C := Commissions

B := Bonuses

F:= Benefits

X := Expenses

D := Deductions

T := Taxes

RH := Regular Hours Worked

OTH := Overtime Hours Worked

LH := Leave Hours

As previously stated, the source of the above variables is Employee Baseline Record. In most payroll systems, the above payroll variables, namely Earnings, Allowance, Commissions, Bonuses, Benefits, Expenses, Deductions, and Taxes, are not distinguished as such, and they are generally called Wage Types. In the majoring of Payroll System, these payroll variables are defined as three types of wages, earnings, deductions, and taxes. On the other Interact Payroll System and its Framework, there is clear distinction between the above variable. As a matter of fact the above payroll variables are the basis of Interact Payroll System Framework.

Interact Payroll System Framework Defined

Unlike other payroll systems, where the above payroll variables including Earnings, Allowances, Benefits, Bonuses, Commissions, Expenses, Deductions, and Taxes are commingled and known as wage types, Interact Payroll System makes clear distinction between these Payroll Variables. In Interact Payroll, these payroll variables are known as Payroll Compensation, Deductions, and Tax Policies. These payroll policies include 8 sets of distinct payroll policies, each representing one payroll variable. These Payroll Policies sets include:

♠ Earning Policies

♠ Allowance Policies

♠ Commission Policies

♠ Bonus Policies

♠ Benefit Policies

♠ Expense Policies

♠ Deduction Policies

♠ Tax Policies

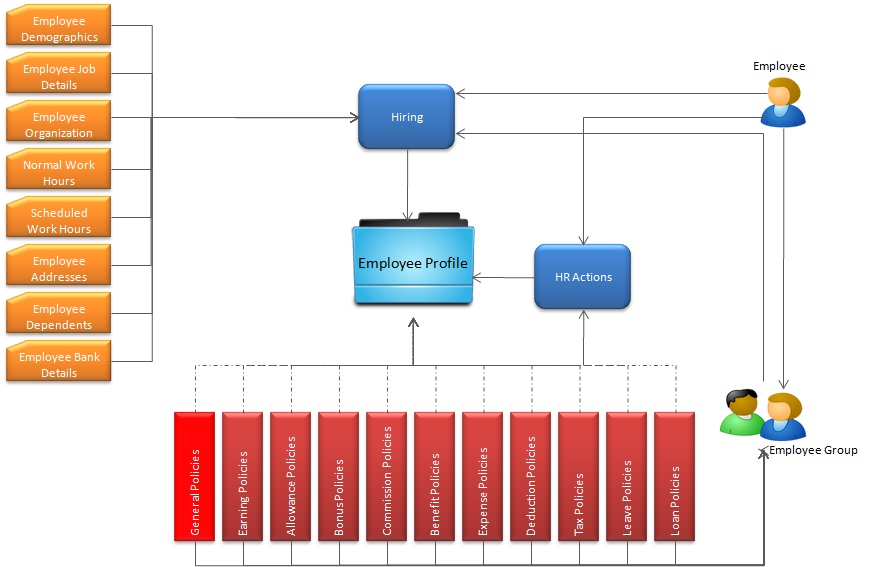

The reason for having the payroll wage types map exactly to the payroll variables, through the above payroll policy sets, is that each payroll policy has different behavior/rules and calculation methods. Example Tax policies behave differently from earning policies, and allowance policies behave differently from benefit policies, etc. And that is why Interact Payroll, makes clearly distinction between these payroll policies and their definition. Each of the payroll policy sets can have unlimited policies, there is no limit as to the number of policies that can be defined in each set. As stated, the above payroll policy sets are the fundamental block of Interact Payroll System Framework. Figure-1 below show how the Payroll Policies are defined and assigned to employees.

Figure-1: Payroll Policies Definition and Assignment

Payroll Policies Definition

There are two categories of Payroll Policies, General Payroll Polices, which such as Employment Type, Pay Type, Job Assignment Type, Normal Work Hours, Pay Periods, Payroll Country, GL Account Structure to be used in the Payroll JV, Leave Accrual Methods and Rates, and others. And Specific Payroll Policies Sets including Earning, Allowance, Bonus, Commission, Benefit, Expense, Deduction, and Tax Policies as well as Leave and Loan Policies. Both categories of payroll policies are defined first at the Employer Level. Definition of the specific payroll policy consists of given a unique code, and name to each policy as well the calculation method that applies to the policy. Once the payroll policies are defined, at the employer level then Employee Groups need to be defined and assigned their general and specific payroll policies.

Payroll Policies and Employee Groups

Employee Groups in Interact are used to group the employees that share payroll policies entitlements. Example of employee groups could be Salaried Employees and Hourly Employees. And within Hourly Employee Group you can divide these further to two employee groups, where you’ll have Hourly Union Employees and Hourly Non-Union Employees. Once the Employee Groups are defined, then, we assign the Payroll Policies applicable to each Employee Group. Beside payroll policies assigned to each employee group, each employee group has its own general payroll policies such as Employment Type, Pay Type, Job Assignment Type, Normal Work Hours, Pay Periods, Payroll Country, Payroll Currency, and GL Account Structure to be used for the Payroll JV, Leave Accrual Methods/Rates, and others. The main purpose of the employee groups is inheritance – The payroll general policy and specific payroll policies are defined only one time at the group level, and when the employee is hired and assigned to the employee group, he/she inherits the general payroll policy of the employee group as well the specific compensation, deduction, and tax policies assigned to the employee group. With this inheritance function, you do not need to assign each employee his/her general and specific payroll policies, thus making employee payroll management easy. Note, however, that the general payroll policies and specific payroll policies can be maintained at the employee profile level to manage particular employees that have specific policies outside the employee group policies.

Payroll Policies and Jobs and Positions

The other option of defining and assigning payroll policies is to define the Payroll Policies at the Job level or Position level depending on the Organization requirements. If this is done, then once an employee is assigned to the Job or Position, he/she will inherit the Job or Position payroll polices.

Employee Payroll Policies Assignments

In Interact Payroll, the payroll policies are assigned automatically by the system when employee is hired through HR, and these can be assigned in four ways as described above:

- Employee Group – Through employee group when employee is assigned his/her employee group during the hiring process.

- Job Classification – Through the job when employee is assigned his/her job during the hiring process.

- Position – Through the position (if you are using position budgeting and control) when employee is assigned his/her position during the hiring process.

- Employee Profile – Through the employee profile to override the payroll policies inherited from the employee group, job, or position.

So you have all the flexibilities in the payroll system to manage the Payroll Policies and their assignments to employees.

Employee Profile

On Employee Hiring through Interact HR (Figure-1), the system, automatically creates the employee profile of the employee. Each employee has one employee profile which is created by the system when the employee is hired. The Employee Profile includes:

◊ Employee ID (Unique Employee ID)

◊ Employee Demographics

◊ Employee Addresses

◊ Employee Dependents

◊ Employee Job Detail

◊ Employee Position Detail (if position budgeting is used)

◊ Employee Organization Detail

◊ Employee Compensations, Deductions, and Taxes (Payroll Detail)

◊ Leave Entitlements

◊ Holidays Entitlements

◊ Employee Bank Detail

◊ Employee Education

◊ Employee Experience

◊ Employee Competencies

◊ Employee Skills

◊ Employee Risks

◊ Employee Performance Plans and Appraisal

◊ Employee Training

◊ Employee Career Plan

◊ Employee Succession Plan

◊ and Other Miscellaneous Information

The employee profile is comprehensive and used as the Employee Electronic Record. The data/information in the employee profile is updated automatically whenever there is an HR action performed for the employee or transactions processed for the employee through other Interact applications. So the employee profile is always up to date. Note that the employee profile is updated through all Interact Applications. So it is the central repository of employee data/information.

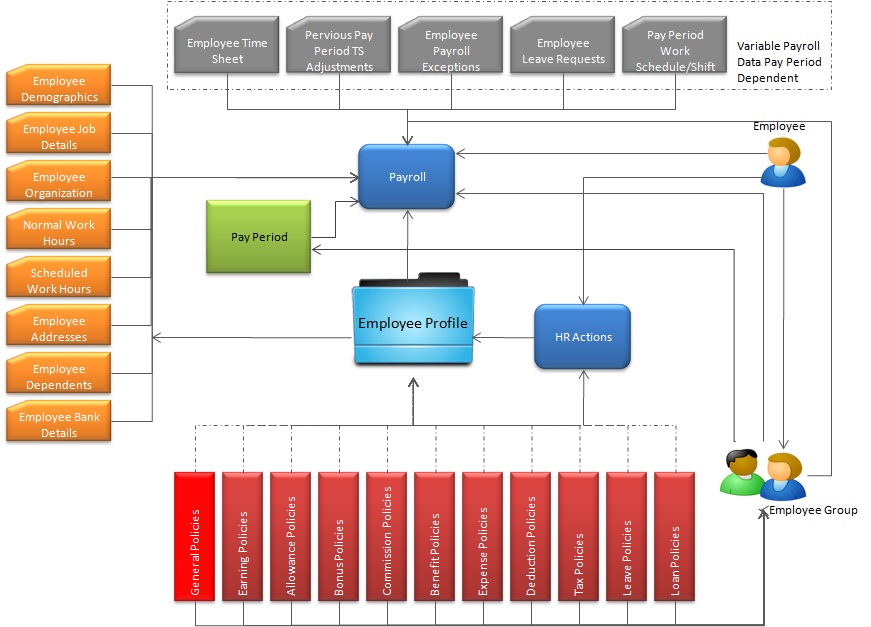

Interact Payroll System Framework

Now that we have defined the basis and components of Interact Payroll System Framework, in this section we shall describe the framework itself. Interact Payroll System Framework is depicted in Figure-2.

Figure-2: Interact Payroll System Framework

At the heart of the framework, is the Employee Profile which is created during employee hiring and updated through the HR Actions that took place during the pay period and effective within the pay period for which the payroll is being run. The payroll system will read all the required employee data and policies from the employee profile. Then, the timesheets including current pay period timesheets and pervious pay period adjustment timesheets and exceptions for the pay period are loaded and posted. The leave data is automatically posted through the leave management system. And for those employees who have work schedules/shifts, the schedules/shifts are automatically posted through the resources management module/application. In summary, Interact Payroll System Framework includes:

- Pay Periods – The Normal Payroll Cycle Payroll is run for specific pay period or pay periods. So you need to open all the pay periods for which the Payroll will be executed. And the pay periods are part of Interact Payroll System Framework. Pay Periods are defined as part of the payroll general policies and assigned to their relevant Employee Groups.

- Employee Groups – The payroll is run by employee group, so the employee group is an integral part of Interact Payroll Framework and needs to be predefined as previously stated.

- Employee Profile – Which include the employee demographics, job, organization, and payroll policies, leave policies, and other payroll related data which has been assigned to the employee during the hiring and subsequently changed as a result of HR Actions issued for the employee.

- Pay Period Specific Data – Which include the employee work schedules/shifts for the pay period, the timesheets for the pay period, the previous pay period adjustment timesheets, payroll exceptions that took place during the pay period, and the leave taken during the pay period which is automatically passed through the leave management module/application.

- Payroll Processes – Interact Payroll System, specifically the Normal Payroll Cycle that we are discussing here, consists of a number of processes that need to be executed/ran to produce the payroll. These payroll processes include:

1. Payroll Initialization

2. Importing and Posting the Timesheets for the Pay Period

3. Importing and Posting Previous Pay Period Timesheets

4. Main Payroll Process know as Automatic Timesheet (ATS)

5. Importing and Posting Pay Period Payroll Exceptions

6. Trial Payroll ( The trial payroll can run as many times as required)

7. Trial Payroll Register

8. Trial Direct Bank Transfer

9. Trial Payroll GL/JV

10. Final Payroll

11. Final Payroll Register

12. Final Direct Bank Transfer

13. Final Payroll GL/JV

14. Pay Period Closing

Note the difference between Trial Payroll Processes and Final Payroll Processes. Trial Processes can be executed as many times as required to verify the outcome of each process. While the Final Processes can be executed one time only, as they commit the final payroll outcome data to the database.

Conclusion

As previously stated, each payroll system has its own framework. In this article, we have described Interact Payroll System Framework which is derived from the Payroll Definition and Calculation Methods which we described in the blog, “The Payroll Miracle”. And we have shown the flexibility of Interact Payroll System due its framework which is policy driven enabling the user to define unlimited payroll policies where all policies are user defined and parameter driven. Nothing is hard-coded.