- Compliance Audits

- Audits Checklist

- Legal Actions

- Lawsuits

- Courts Orders

Interact SSAS Compliance Management ensures that employers comply with social security laws and regulations by monitoring employment reporting, wage filings, contribution filings, and payments. The module supports audits, corrective actions, legal proceedings, and court-enforced compliance measures. It integrates with employer records, contribution filings and payments, and delinquency management to provide a streamlined compliance framework.

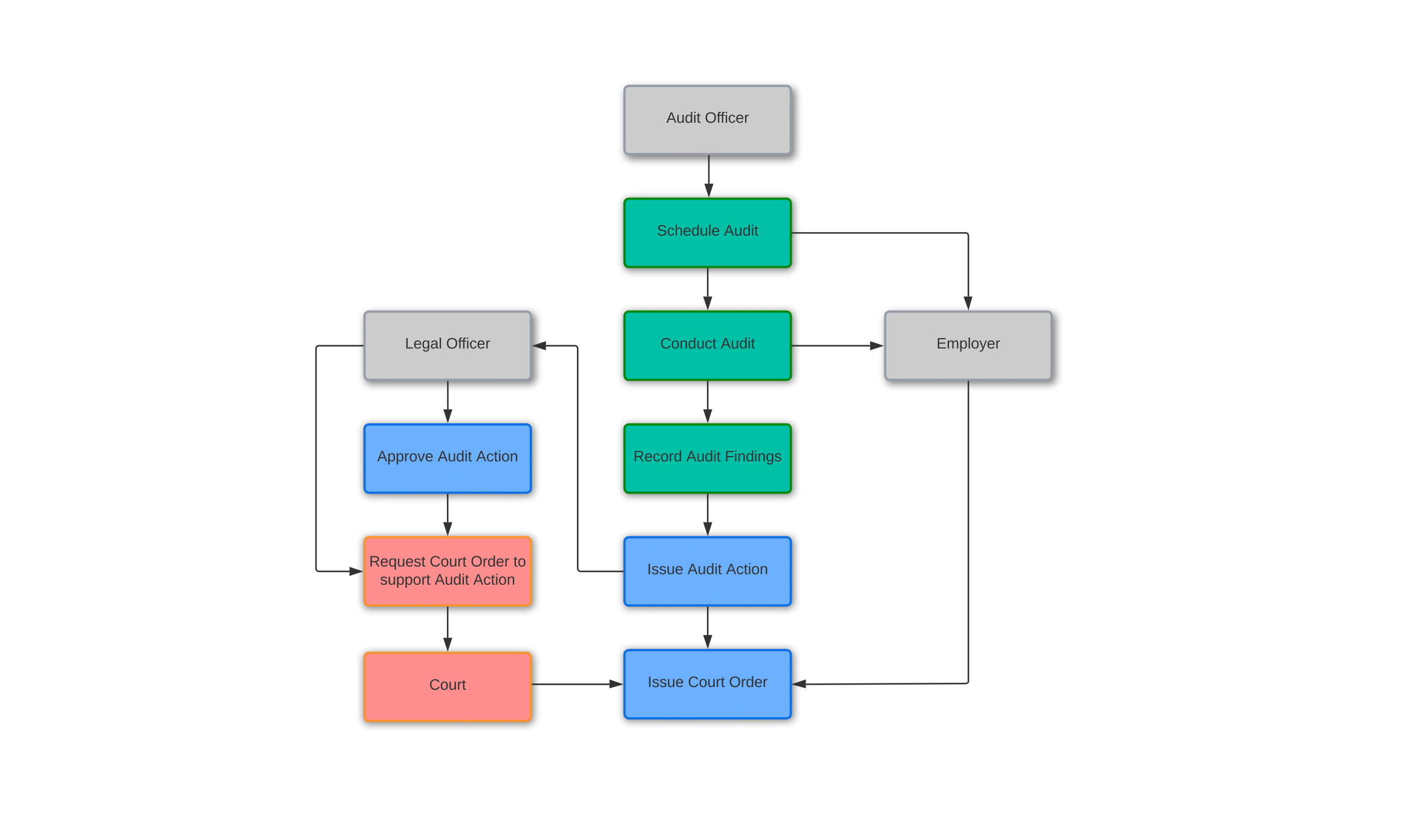

Figure 1: Compliance Audit Workflow

Features and Processes

Employer Compliance Monitoring

- Ensures employers report employee counts accurately.

- Validates that employers file wages and contributions correctly and on time.

- Tracks employer payments and flags delayed or incorrect payments.

- Monitors employer submission of supporting documents for wage and contribution filings.

Compliance Audit and Inspection

- Enables periodic audits of employers based on predefined schedules or ad hoc inspections.

- Generates compliance audit checklists to guide audit officers in verifying employer records.

- Allows audit officers to record findings and assess employer compliance.

Compliance Audit Findings and Actions

- Captures audit outcomes, indicating whether employers are compliant or non-compliant.

- Enables auditors to recommend actions such as correction of records, contribution adjustments, and payment of outstanding amounts.

- Tracks employer responses to audit findings and recommended actions.

- Generates notices to employers specifying corrective actions required.

Follow-up and Legal Enforcement

- Ensures follow-up on outstanding compliance issues to track corrective action implementation.

- Escalates unresolved compliance issues to legal officers for further action.

- Supports legal action against employers who fail to comply, including issuing legal notices and court filings.

- Supports documenting lawsuits filed against employers.

- Tracks court-orders mandating employer compliance with social security obligations.

Arrears Installment Agreements

- Supports creating Arrears Installment Agreement terms with agreed amount, interest rate, installment frequency and installment amount

- Routes agreement to employer for review and approval

- After Arrears Installment Agreement is approved, payment schedule is generated based on the agreed parameters

- Payments are collected against the Agreement and tracked separately from regular contributions and penalties payments for current dues

Compliance Audit Workflow

- Audit Scheduling – Employers are assigned to audit officers based on predefined regions and audit cycles.

- Compliance Audit Initiation – The system generates compliance audit records and notifies employers.

- Audit Checklist Preparation – Compliance officers use structured checklists to conduct audits.

- Audit Execution – Onsite or remote audits are conducted to verify employer records.

- Audit Findings Documentation – Compliance officers record compliance statuses and identify violations.

- Recommended Compliance Actions – Officers propose corrective actions for non-compliant employers.

- Audit Action Approval – Legal officers review and approve corrective measures.

- Employer Notification and Follow-up – Employers receive notifications on actions required and deadlines.

- Legal Action Escalation – Non-compliant employers face legal proceedings and court-mandated orders.

- Arrears Installment Agreements – Payment agreements can be created and sent for review and approval to employer after which payment schedule is generated

Compliance Management Setup

- General Setup: Defines compliance audit rules, numbering standards, workflow approvals, and statutory interest rates.

- Regions, Districts, and Cities: Assigns employers to specific geographic jurisdictions for audit oversight linked with audit officers and legal officers.

- Courts and Legal Entities: Defines court entities involved in social security compliance enforcement.

- Audit Performance Cycles: Configures scheduled compliance audit frequencies.

- Audit Reasons and Scope Items: Establishes predefined audit triggers and areas of inspection.

- Audit Documents and Checklist Items: Standardizes required documentation and verification items for audits.

- Audit Action Types and Reasons: Specifies possible corrective actions and their legal justifications.

- Lawsuit Management: Defines legal case handling, lawsuit types, court procedures, and compliance litigation tracking.

Audit Performance and Reporting

- Tracks detailed compliance reports for auditors and social security administrators.

- Provides real-time dashboards to track pending audits, employer responses, and legal proceedings.

- Offers configurable alerts and notifications for upcoming audits and legal deadlines.

Integration with Other Modules

- Employer Management: Ensures registered employers meet compliance requirements.

- Contribution Filing and Payment: Links compliance actions to delinquent contributions.

- Legal Case Management: Tracks lawsuits, court rulings, and compliance enforcement measures.

- Delinquency Management: Identifies employers with outstanding payments and enforces corrective actions.

Interact SSAS Compliance Management provides a structured, automated solution for ensuring employer compliance with social security regulations. It supports proactive auditing, legal enforcement, and corrective action tracking while integrating with key modules such as employer registration, contribution filing, and delinquency management. By automating compliance processes and providing real-time oversight, this module helps social security administrations maintain integrity and enforce accountability among employers.

Interact SSAS Compliance Management supports the Social Security Administration to ensure that all external stakeholders are complying with the Social Security laws and regulations and this includes making sure that:

- Employers are reporting their employment count – How many employees are employed by the employer

- Employers are filing their employees’ wages correctly and in a timely manner

- Employers are filing social security contributions correctly and in a timely manner

- Employers are paying for the filed social security contributions correctly and in a timely manner

- Employers are providing all supporting documents with regard to employees’ wages and contributions

- Employers are audited (inspected) from time to time to ensure that they are complying with the above rules and regulations

- The outcome of each audit is recorded and reported with the recommended action(s)

- Employers are notified of their non-compliance and follow up is conducted to ensure that the employers have implemented the required actions as recommended by the social security administration

- In case employers have not taken the corrective actions and are still delinquent, the social administration, through its legal officers, can elect to pursue them in court to enforce the actions resulting from the audit

- Audit outcome actions may include notices to correct the employer record keeping, correct the contributions filing, make the pending/delayed contribution payments, penalties and fines for delinquent filings or payments, etc.

- Social Security may file lawsuits against employers who are delayed in making contribution payments

- The court may issue court orders to employers to pay the contributions that are in arrears

The Social Security Compliance Management process is the last process of the Social Security Administration System (SSAS), hence the following order of SSAS processes:

- Registration Management

- Social Security Number Management

- Benefits Contribution and Payments

- Benefits Claims and Payments

- Compliance Management

Actors

The actors in the Social Security Compliance process/function include internal actors which consist of Auditors (Compliance Inspectors or Audit Officers) and Legal Officers. External actors include Employers, Healthcare Providers, and the Courts. Each of these actors have a specific role in the Compliance process (Figure-1):

Auditors (Audit Officers) – Auditors are responsible for scheduling and conducting the compliance audits of the employers in accordance with specific rules and regulations and reporting of the findings of each audit and recommending what audit actions are to be taken. Other terms which may be used for a similar role are:

- Audit Officer

- Audit Inspector

- Compliance Officer

- Compliance Inspector

- Inspector

Legal Officers – Legal Officers are responsible for receiving the recommended audit actions and making the final decision on what action needs to be taken to correct the non-compliance of the employers. Other terms which may be used for a similar role are:

- Counselor

- Legal Advisor

- Legal Counselor

Employers – Employers are responsible for making all employees, wages, and contributions filings and payments records available to the Audit Officers (Auditors) and responding to any request of information from the auditors and implementing the recommended actions made by the auditors. If ordered by a Court, they must comply with the court orders including making payment for any unpaid contributions and fines.

Courts – The courts are responsible for reviewing the social security audit actions and ordering the employers to comply with specific orders of the court which are resulting for the social security compliance audit actions and findings.

Figure-2: Compliance Audit Actors

Workflow

The workflow of the compliance process starts with defining the Audit Officers, Legal Officers, and the Courts, and then assigning employers to each Audit Officer. Each Audit Officer is assigned to a specific region and district in the country and a number of employers within the regions. Each audit officer is responsible for the compliance of a number of employers. Once the actors are defined, then the following processes take place (figure-2):

Audit Scheduling (Schedule Compliance Audit) – This process consists of scheduling a compliance audit based on the predefined compliance audit cycle. Note however, not all social security organizations have a schedule for compliance audits. Some organizations may conduct compliance audits in an ad hoc manner based on the discretion of the audit officers.

Compliance Audit – Once the audit schedule is defined, a Compliance Audit record is created and the employer is informed of the Audit Date and Time and Reason of the audit.

Compliance Audit Checklist – On or before the date of the Audit, a Compliance Audit Checklist is printed to be used during the Audit visit by the Audit Officer.

Compliance Audit – On the date of the compliance audit, the audit officer visits the employer and conducts the audit using the Compliance Audit Checklist and record his/her findings.

Record Compliance Audit Findings – Once the audit is conducted, the audit officer will record the outcome of the audit as to whether the employer is compliant or not with the reason for non-compliance.

Recommend Compliance Audit Action – Based on the audit findings, the auditor will recommend a compliance/audit action resulting from non-compliance.

Review and Approve Compliance Audit Action – The management and the Legal Officer will review and approve the recommended Compliance Audit Action, and once approved to a notice of the recommended Compliance Audit action is sent to the employer to implement the issued Audit Action.

Follow up on the Compliance Audit Action – An Audit officer will follow up with the employer to ensure that the Compliance Audit Action has been implemented by the employer. If not, the Audit Officer will send a notice to the Legal Officer to take further action.

Court Issue Court Order to Employer – The court will review the non-compliance audit action and issue a court order to the employer to comply with the specific audit action.

Setup

The initial Setup required for the Compliance Management module includes the following:

- General Setup

Figure 3: General Setup

In the General Setup all the main rules are defined which will drive the basic logic, numbering standards, initial workflow and methods to be used such as

- Compliance Audit Schedule

- Lawsuit Numbering

- Compliance Audit Cycles

- Audit Action Approval Workflow

- Compliance Rating Type

- Compliance Audit (Manual vs. Automatic)

- Interest Rate for Statutory Interest

- Regions

Figure 4: Regions Setup

The user can define any number of Regions which will be associated with Districts and Cities as part of the classification of Employers for which Audit Officers will be responsible.

Figure 5: Region Definition

The regions can be defined with a Code and a Name as well as a color which can be used for color coding in reports. Statistics are generated by the system by region.

- Districts

Figure 6: Districts List

The system will display all the Districts defined, each District can be linked with a Region.

Figure 7: District Definition

Defining a new District is done easily using a District Code and District Name as well as a Color for color coded reports.

- Cities

Figure 8: Cities List

All Cities can be defined in Interact SSAS to allow for easy classification of Employers by location.

Figure 9: City Definition

Cities can be defined with a City Code and City Name, after which they will be linked with a Region and District and a Color. The use of Codes ensures that even Cities with identical names can be classified correctly with the right Region and District.

- Zip Codes

Figure 10: Zip Codes

Zip Codes may be used to help in classifying employees, the system allows the user to define any number of Zip Codes.

Figure 11: Zip/Postal Code Definition

- Courts

Figure 12: Courts Listing

Since Courts are important Actors in the Compliance process, these will all be defined in the system.

Figure 13: Court Definition

Courts are defined with a Court Code and Court Name, as well as their address and the Court Officer.

- Audit Performance Cycles

Figure 14: Audit Performance Cycle List

Audit Performance Cycles are fully user-defined and can be setup as per the practice of the Social Security Administration. The system will then auto-create Audit Schedules based on these Cycles or can allow the Social Security Administration to set the dates for Audits manually.

Figure 15: Audit Performance Cycle Definition

Different Audit Cycles can be associated with different Districts, Regions, Employer Groups, Employer Types etc., for maximum flexibility and efficiency.

- Audit Reasons

Figure 16: Audit Reasons Listing

Depending on the Audit Policy Framework in use within the Social Security Administration, the user can define any set of Audit Reasons which can be invoked and shared with the Employer when an Audit is scheduled.

Figure 17: Audit Reasons Definition

Defining new Audit Reasons is very simple in Interact SSAS and is done as usual with a Code and a Description/Name. In addition, this form allows the user to set an Importance Level for the Reasons and a Color Code.

- Audit Scope Items

Figure 18: Audit Scope Items List

The Scope of Audits will depend on the governing laws and regulations in the country as well as the local context. Therefore the entire framework is fully configurable and user-defined. Above you can see a set of Audit Scope Items which can then be included in any Audit.

Figure 19: Audit Scope Item Definition

Defining Audit Scope Items is simple with an Item Code, an Item Description, Audit Reasons which are associated with it, and the Audit Scope Urgency Level as well as Color Coding for easy Reporting.

- Audit Documents

Figure 20: Audit Documents List

The user can define any Audit Documents which may be used in an Audit as evidence or to support a statement made by the Employer. This way reporting on such Audit Documents is standardized and streamlined.

Figure 21: Audit Documents Definition

Audit Documents can be defined with the Document Code and Document Name and Description, as well as classified based on their Type. The Audit Document can then be linked with the Audit Scope Items where it will be Required. Color coding is available as with most other definitions in Interact SSAS.

- Audit Types

Figure 22: Audit Types List

In order to effectively manage and schedule the right Types of Audits, these should be classified by Type in order for the organization to be able to prioritize as required when scheduling.

Figure 23: Audit Types Definition

Each Audit Type can be defined with extensive information and linked with a specific Performance Cycle and with a particular Audit Scope.

- Compliance Audit Checklist

Figure 24: Compliance Audit Checklist

Each Audit which is conducted will be based on a specific Compliance Audit Checklist, which will contain all the items that must be checked and verified during the Audit. The Audit Officer will be able to print the Audit Checklist and document all necessary elements that are verified during the Audit.

Figure 25: Compliance Audit Checklist Item Definition

There is no limit on the number of Compliance Audit Checklist Items which can be defined. Each can be associated with an Audit Type, Audit Reasons, and linked with Employer Types, Employer Groups or Healthcare Providers.

- Audit Action Types

Figure 26: Audit Action Types List

The Audit Actions which may result as the outcome of an Audit are fully configurable as part of the Audit Framework which the Social Security Administration wants to implement.

Figure 27: Audit Action Types

Audit Actions Types can easily be defined with a Code & Description, associated with a Severity level, an Action Form and a Color. In addition, each type of Audit Action can be associated with a different Audit Action Type Workflow.

- Audit Action Reasons

Figure 28: Audit Action Reasons List

In order to take an Audit Action there will be a need to provide an official Reason, depending on the laws and regulations in the country and the policies in place at the Social Security Administration. The system will allow the user to define any number of Reasons which will be invoked when initiating an Audit Action.

Figure 29: Audit Action Reason

Defining Audit Action Reasons can be done with a simple Reason Code, Reason Description and a Severity Level with Color Code.

- Audit Actions

Figure 30: Audit Actions List

Once the Audit Action Types and Audit Action Reasons have been defined, we can define the individual Audit Actions which fall under each Type. This way, the correct Audit Actions will be listed by the system when a user is managing a particular Audit Action Type.

Figure 31: Audit Action

Defining individual Audit Actions can be done using the simple form above which allows for the Audit Action Code and Description as well as various classifications to be setup.

- Lawsuit Reasons

Figure 34: Lawsuit Reasons List

One critical outcome of a Compliance Audit may be that the Social Security Administration will take legal action in court. In order to track the various Reasons for which such Lawsuits are initiated, the system uses a validated list of codified Lawsuit Reasons which can be configured as required.

Figure 35: Lawsuit Reason

The definition of Lawsuit Reasons is a simple as all other definitions in Interact SSAS, using Reason Codes and Descriptions as well as Severity Levels and Color Codes.

- Lawsuit Types

Figure 36: Lawsuit Types

Since there may be different Types of Lawsuits, each for different Reasons, the system allows the user to define the Types of Lawsuits in the Compliance Framework.

Figure 37: Lawsuit Types Definition

Defining a new Lawsuit Type is simple with a Code and Description, together with the Minimum and Maximum Debt Threshold which may determine the type of Court and Lawsuit that will be initiated.

- Lawsuit Methods

Figure 38: Lawsuit Methods List

The different Legal or Lawsuit Methods which may take place in the legal process can be defined so that the status can be tracked carefully

Figure 39: Lawsuit Method

Defining the Lawsuit Method only requires a Code and Description.

- Lawsuit Statuses

Figure 40: Lawsuit Status Listing

The manner in which to track the Status of a Lawsuit and the actual Status itself is fully configurable.

Figure 41: Lawsuit Status Definition

Creating a Status with Code and Description is straight-forward.

Workflow

Once the setup has been completed for the Compliance Management module, the various Actors and Users can start performing their Actions.

Below is an example of the Workflow which will be followed.

- Step 1: Audit Scheduling

Figure 42: Compliance Audit List – Compliance Audit

Figure 43: Compliance Audit List – Compliance Audit Schedules

Audit Scheduling (Schedule Compliance Audit) – This process consists of scheduling a compliance audit based on the predefined compliance audit cycle. Note however, not all social security organizations have a schedule for compliance audits. Some organizations may conduct compliance audits in an ad hoc manner based on the discretion of the audit officers.

- Step 2: Compliance Audit

Figure 44: Compliance Audit

Compliance Audit – Once the audit schedule is defined, a Compliance Audit record is created and the employer is informed of the Audit Date and Time and Reason of the audit.

- Step 3: Compliance Audit Checklist & Findings

Figure 45: Audit Checklist List

Figure 46: Audit Checklist Details

Compliance Audit Checklist – On or before the date of the Audit, a Compliance Audit Checklist is printed to be used during the Audit visit by the Audit Officer.

Compliance Audit – On the date of the compliance audit, the audit officer visits the employer and conducts the audit using the Compliance Audit Checklist and record his/her findings.

Record Compliance Audit Findings – Once the audit is conducted, the audit officer will record the outcome of the audit as to whether the employer is compliant or not with the reason for non-compliance.

Recommend Compliance Audit Action – Based on the audit findings, the auditor will recommend a compliance/audit action resulting from non-compliance.

- Step 4: Audit Action

Figure 47: Audit Action List

Figure 48: Audit Action Details

Review and Approve Compliance Audit Action – The management and the Legal Officer will review and approve the recommended Compliance Audit Action, and once approved to a notice of the recommended Compliance Audit action is sent to the employer to implement the issued Audit Action.

- Step 5: Legal Action

Figure 49: Legal Action List

Follow up on the Compliance Audit Action – An Audit officer will follow up with the employer to ensure that the Compliance Audit Action has been implemented by the employer. If not, the Audit Officer will send a notice to the Legal Officer to take further action.

Figure 50: Legal Action – General

Figure 51: Legal Action – Legal Action Notices

- Filing Lawsuit

Figure 52: Lawsuit List

Figure 53: Lawsuit

If the Employer is not taking Action as per the Audit Actions recommended, then the Social Security Administration will be forced to take Legal Action and after advising of the intent to do so, the Social Security Administration can initiate the Lawsuit and record all details in the system for reference and managing the case information.

- Step 7: Court Orders

Figure 54: Court Orders List

Figure 55: Court Order

If after the filing of the Lawsuit the Employer remains non-compliant and the Social Security Administration prevails in Court, the Court will Order the Employer to comply.

Figure 2: Compliance Audit Finding

Figure 2: Compliance Audit Finding