![]() Before you commence Interact HRMS implementation and setup, you need to understand the Implementation Framework and Stages of Interact HRMS as this understanding is very critical to conducting a successful and timely implementation. This section describes the Implementation Framework and Stages of Interact HRMS.

Before you commence Interact HRMS implementation and setup, you need to understand the Implementation Framework and Stages of Interact HRMS as this understanding is very critical to conducting a successful and timely implementation. This section describes the Implementation Framework and Stages of Interact HRMS.

Implementation Framework

Interact HRMS Implementation Framework is defined by the components that need to be defined in order to implement Interact HRMS. These components are defined as follows and as shown in figure-1:

Figure-1: Interact Implementation Framework

Figure-1: Interact Implementation Framework

Foundation

These are the business entities of the company/organization within which Interact HRMS will be implemented and to which the company HR and Compensation and Payroll policies will be applied. These business entities or foundation elements consist of the following:

– Enterprise

– Employers

– Organization Units

– Employee Groups

– Job Classification

– Cost Centers

– GL Accounts

– Chart of Account Structure

– Fiscal Year and Periods

– Locations

– Banks

– Bank Accounts

– Pay Periods

– Statutory Holidays

– Clients

– Projects

– Third Party Payees

– Tax Agencies

– Shift Type, Shifts, and Shift Patters

Enterprise: The enterprise is the business entity that owns HRMS. The enterprise is the legal business entity and can be made of more than one employer, depending on the business structure. Interact HRMS is implemented in support of one Enterprise and multiple employers within a single enterprise. Thus, you can have only one enterprise. An enterprise can be viewed as a group of companies/employers. However and in most cases, the Enterprise is the same as the employer. The enterprise is created during the installation of Interact software.

Employers – An employer is a company, institution, or organization for which you’ll be implementing Interact HRMS. An employer belongs to the enterprise. Interact HRMS can be implemented for multiple employers under a single enterprise. Again, in most cases you’ll have one employer and one enterprise. When hiring an employee, and employee is hired to work for an employer, not for an enterprise.

Employer Organization Structure – Each employer has an organization structure that defines the organization units that make the employer. Organization units can be divisions, departments, sections, projects, and work units. When an employee is hired he/she must be assigned to an organization unit.

Employee Groups – For purpose of ease of management of employees, employees are grouped into employee groups or employee payroll groups. The grouping of employees is decided based on the employees that share the same work, leave, time, and compensation policies. For example Salaried Employees and Hourly Employees, where the first group does not get paid overtime and does not require timesheets, while the second group is paid overtime and requires timesheet.

Job Classification – The job classification is used to define the job titles that will be assigned to employees and how these job titles are grouped for the purpose of reporting, career planning, and competencies management. When hiring an employee, the employee must be assigned a job title.

Cost Centers – Cost Centers are used in support of the Labor Distribution and to allocate the Payroll costs. Org Units are assigned cost centers to frame the GL Accounts to which the payroll costs will be allocated.

GL Accounts – These are the GL Natural Accounts which including asset, liability, and expense accounts which are used to post the Payroll Journal Transactions. Combined with cost centers, they frame the fully qualified GL Accounts to which the Payroll JV Transactions are posted and passed to the Financial System at the end of each pay period.

Chart of Account Structure – This is used to define the segments used in framing the fully qualified GL Account including Natural Account segment, cost center segment, and other segments.

Fiscal Year and Periods – Used to define the Fiscal Year and Fiscal Periods during the year, so to map the Pay Periods to the Fiscal Periods for costing and financial reporting purpose.

Locations – Locations are used to identify where the paychecks will be distributed in case employee salaries are issued in checks and/or cash.

Banks – Banks are used to define the employer banks from which the salaries and other payroll expenses will disbursed as well the employees’ banks to which the employees’ salaries will be electronically transferred.

Bank Accounts – Bank Accounts are used to define the employer bank Accounts from which the salaries and other payroll expenses will disbursed as well the employees’ bank accounts to which the employees’ salaries will be electronically transferred.

Pay Periods – The pay periods are used to define the pay check cycle, meaning the time periods at the end of which the employee is paid. Pay Periods can be weekly, biweekly, semi-monthly, monthly, or any other

Statutory Holidays – Statutory holidays are the paid public holidays that the employees are entitled to during the year.

Clients – Clients are those clients for which employer provides employees to conduct certain services for which the client is charged. And thus these impacts the cost of payroll as well as billing and labor costing.

Projects – Projects are defined if the employer does payroll costing and billing by projects.

Third Party Payees – Third party payees are health insurance providers, benefit providers, and others that employer must pay certain portion of the employee salary as a result of specific benefits paid for by the employee, employer, or both.

Tax Agencies -The tax agencies need to be defined so that state and tax withholdings can be paid to the relevant tax agencies.

Shift Types, Shifts, and Shift Patterns – If employer has employees who work on shift or using 24/7 shift operation, then these must be defined as employees who are on shift, must be assigned to their shift schedule.

With the exception of employee groups, all above business entities that make the foundation must be defined first before proceeding with the definition of the HR and Payroll policies.

Policies

Policies are used to define the employer policies that govern HR, Leave, Time and Attendance, Compensation, Payroll, Training, and others. Under Interact HRMS, and depending on the application to be implemented, these policies must be defined, before HR Actions can be processed using Interact HRMS. Defining these policies through interact captures the organization policies that govern the HR actions and Payroll Transactions and how they will be processed through Interact HRMS. Each Interact HRMS application has specific set of policies that need to be defined. These policies are defined as general policies or general setup and as the detailed policies. Once the foundation is defined, then you need to define the general and detail policies as they are applied to each Interact HRMS application. The following are the group of policies that apply to HRMS core modules and compensation and payroll:

– Financial Policies

– Hiring and Contracting Policies

– Time Reporting Policies

– Leave Policies

– Compensation and Payroll Policies

As some policies will require the definition of other policies, thus the definition of policies must be conducted in specific sequence.

Employee Baseline Data

Since Interact HRMS is implemented and deployed in organizations that have already a number of employees and where the employee personnel record is already available in some electronic format either in an existing HR/Payroll system database or in Excel format. After setting up the foundation, you need to migrate the HR and Payroll baseline data which consists of employee demographics, job detail, compensation data, and bank data.

Before you can migrate/import HR and Payroll employee baseline data, you need to setup the foundation and the policies first. Additionally, data to be migrated/imported into Interact use codes from the foundation and policies definitions. Thus you need make these codes available when formatting the baseline data to be imported into Interact HRMS.

Employee Year-to-Date Earnings

In certain countries tax withholding depends on Year-to-Date (YTD) Earnings, Deductions, and Tax Withholding. In this case before commencing the validation process and going live with the Payroll, the YTD Earnings, Deductions, and Taxes must be defined and loaded in the system.

Leave Balances

Leave Balances are used to define the leave days/hours taken by the employee to date, as these will impact future leaves requested by the employee. Thus, the Leave balances must be defined and loaded in the system before going live with the Leave Management module and the Payroll. ed as part of the initial setup or postponed until the system is live.

HR and Payroll History Data

While HR and Payroll baseline data is used to process HR and Payroll transactions, historical data is used primarily for viewing employee HR Actions history and this data is not used for processing any future transaction. Hence this can be defined and loaded at later stage.

Setup Stages

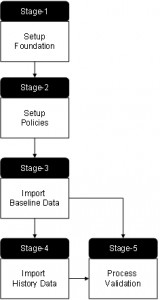

Interact HRMS setup consists of five main stages. These stages are mapped directly to Interact Implementation Framework components as follows:

Figure-2: Interact Implementation Stages

It is critical that you setup Interact HRMS using the above stages and in the sequence given above. First Stage-1, then Stage-2, then Stage-3. And finally Stage-5. Note that in most cases Stage-4 will not be required. However, if required, it can be executed in parallel with Stage-5.

Setup Stage-1: Setup Foundation

This stage is the first setup stage, and consists of defining the foundation elements of Interact HRMS which includes:

- Enterprise

- Employers

- Organization Units

- Employee Groups

- Job Classification

- Cost Centers

- GL Accounts

- Chart of Account Structure

- Fiscal Year and Periods

- Locations

- Banks

- Bank Accounts

- Pay Periods

- Statutory Holidays

- Clients

- Projects

- Third Party Payees

- Tax Agencies

- Shift Type, Shifts, and Shift Patters

Note that though employee groups are part of the foundation definition. The definition of the employee groups is documented, but should not be defined in Interact HRMS until all policies are defined in Interact HRMS as the employee groups need to inherit these policies.

Setup Stage-2: Policies Definition

This is the second setup stage, and consists of defining the general and specific policies pertaining to each Interact HRMS application to be implemented. In the case of HR Core Applications and Interact Compensation and Payroll, you need to setup:

- Financial Policies

- Contract & Hiring Policies Definition

- Compensation and Payroll Policies Definition

- Time and Leave Policies Definition

Financial Policies

- This step consists of defining the following:

- Fiscal Years and Periods

- Banks and Accounts

- GL Accounts

- GL Account Sets

Contact and Hiring Policies

This step consists of the definition of the following policies:

- Employment Setup

- Contract Types Definition

- Contract Template

- Employment Termination Types

- Letter Templates Setup

- HR Activities

Time and Leave Policies

This step consists of defining the time and leave policies:

- Time and Leave Setup

- Leave Policies Definition

- Group Leave Policies Definition

- Group Leave Entitlement Policies Definition

- Timesheet Format Definition

- Travel Agencies Definition

- Overtime Request Setup

Compensation and Payroll Policies

This step consists of the definition of the following compensation and payroll policies:

- Payroll General Parameters

- Holidays Calendar

- Payroll Calendar

- Work Calendar

- Earning Policies Definition

- Allowances Policies Definitions

- Benefits Policies Definition

- Bonuses Policies Definition

- Commission Policies Definition

- Deduction Policies Definition

- Expense Policies Definitions

- Tax Authority Definition

- Tax Policies Definition

- Labor Distribution Activities

- Lab Distribution Activity Group Definition

- Payroll Delivery Locations

Note that where there is a reference to employee group policy, the employee group must be defined first as the policy cannot be assigned to the group if the employee group is not defined.

Setup Stage-3: Import Employee Baseline Data

This stage consists of the migration of the employee baseline data from existing system or Excel spreadsheet to Interact HRMS. There are four primary employee information segments that need to be migrated:

- Employee Demographics

- Employee Job Detail

- Employee Compensations

- Employee Bank Detail

As it may take time for the client to collect and format the data in the desired format, it is critical to initiate this stage as early as possible during the project life. In addition to the above the following must be imported:

- Year-to-Date Earnings

- Leave Balances

Note that that certain information that need to be provided for importing baseline data need to be coded using the codes of the relevant data entity. For example earnings need be identified by their policy code as defined in the policy definition. Thus baseline data cannot be provided until the coding of the policies and other information entities are completed. A work round is to use the descriptive name consistently and later on to replace it using find and replace with the appropriate code.

Setup Stage-4: History Data Import

This stage consists of migrating employee HR, Leave, and other history transactions. In the majority of projects, migrating history data will not be required. However, if it is required, then stage should be conducted last as it does not have any direct impact on current HR and Payroll processes.

Setup Stage-5: Process Validation

This is the most critical stage of the project as it is used to validate HR and payroll processes and associated transactions against the defined foundation and policies that supposed to reflect the client organization and HR and Payroll policies. The outcome of this stage is for the client to validate the output from each Interact process against the expected output which is defined in transaction validation cases. This process is specifically important to validate the payroll, where payroll history run manually or using existing system is validated against Interact Payroll run for the same pay periods.